Bridging the Longevity Liquidity Gap: Unlocking Investment Capital to Fuel the Next Stage of Longevity Industrialization

- Longevity Book

- Sep 18, 2025

- 2 min read

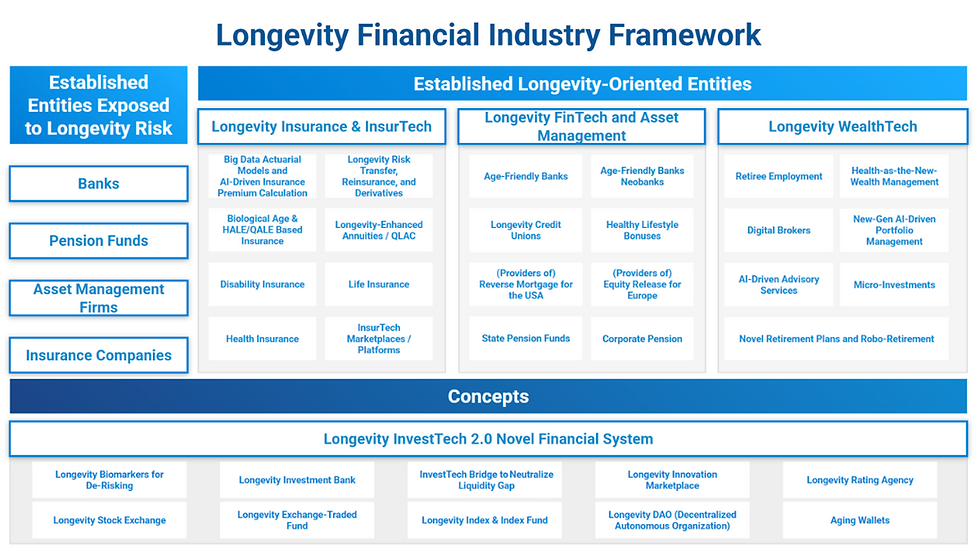

As we look toward the future of the Longevity Industry, it is becoming increasingly clear that we must overcome one of its most pressing challenges: the Longevity liquidity gap. In simpler terms, this gap refers to the disconnect between the growing demand for Longevity-related innovations and the lack of investment capital available to fund the necessary developments in biomedicine, technology, and healthcare. This gap, if left unaddressed, could stunt the progress of this transformative industry, keeping groundbreaking advancements out of reach for those who need them most.

To address this, the financial sector must evolve. Traditional investors, who are typically risk-averse and conservative, need to change their business models to embrace the massive opportunities that Longevity presents. To do this effectively, we must first redefine the way we think about Longevity itself. It is not just about living longer; it’s about living healthier, more productive lives. This fundamental shift in perspective is key to unlocking the investment potential of this sector.

The Longevity Industry, when fully realized, will become a multi-trillion-dollar market. However, for it to reach its full potential, we need a more robust framework that allows for sustainable investment. This involves the creation of novel financial instruments tied directly to Longevity. For example, survivor bonds—where coupon payments are based on the percentage of a defined population that survives to a certain age—could become a vital tool for risk management. These bonds would allow investors to hedge against the risks associated with aging populations while also reaping the benefits of increased longevity.

Additionally, as we develop new financial tools, such as Longevity swaps and futures tied to national healthcare systems, we must consider how to make these instruments liquid, tradeable, and bankable. This is where innovation in both financial products and technologies like AI and blockchain becomes critical. By integrating these technologies, we can provide more transparent, data-driven predictions about the financial implications of aging populations, making it easier for large institutions to see Longevity as a viable asset class.

The future of the Longevity industry depends on this transformation. Financial institutions that fail to adapt will miss out on one of the most significant economic opportunities of the 21st century. Conversely, those that lead the way in developing and supporting Longevity-focused financial products will position themselves at the forefront of a rapidly expanding sector.

It’s time for investors to recognize the true value of Longevity. With the right frameworks in place, we can unlock unlimited capital that will fuel the next stage of the Longevity revolution, benefiting not only the financial world but also the millions of people around the globe who will enjoy longer, healthier lives as a result. The question is no longer if the Longevity industry will reshape our economies—it’s a question of how quickly we can make it happen. And that, I believe, is where the real opportunity lies.

In the upcoming articles, we will explore the specifics of these financial instruments and the profound impact they will have on reshaping our healthcare systems, our economies, and ultimately, our lives. Stay tuned, as we delve deeper into this exciting future and the groundbreaking innovations that will help us achieve it.

Comments